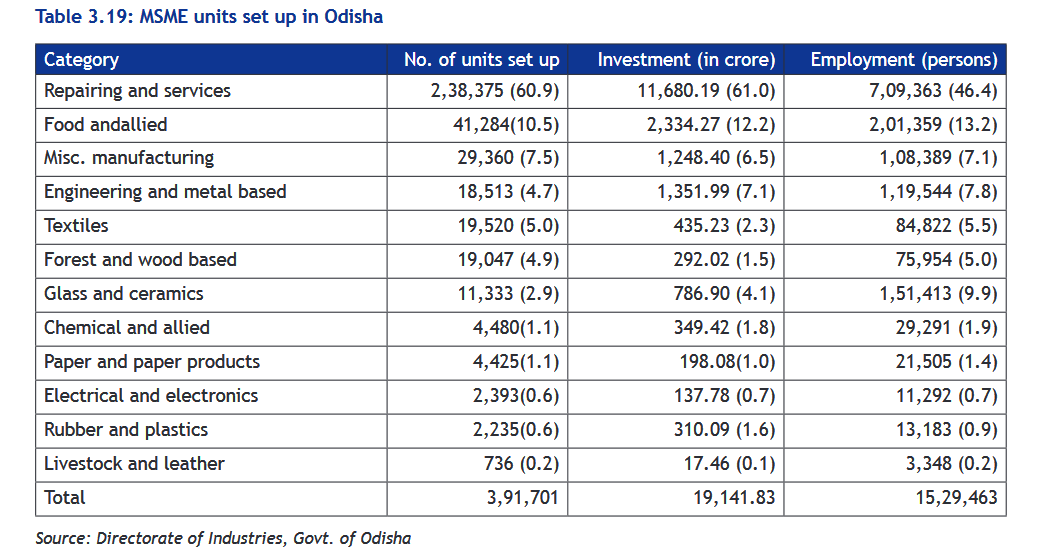

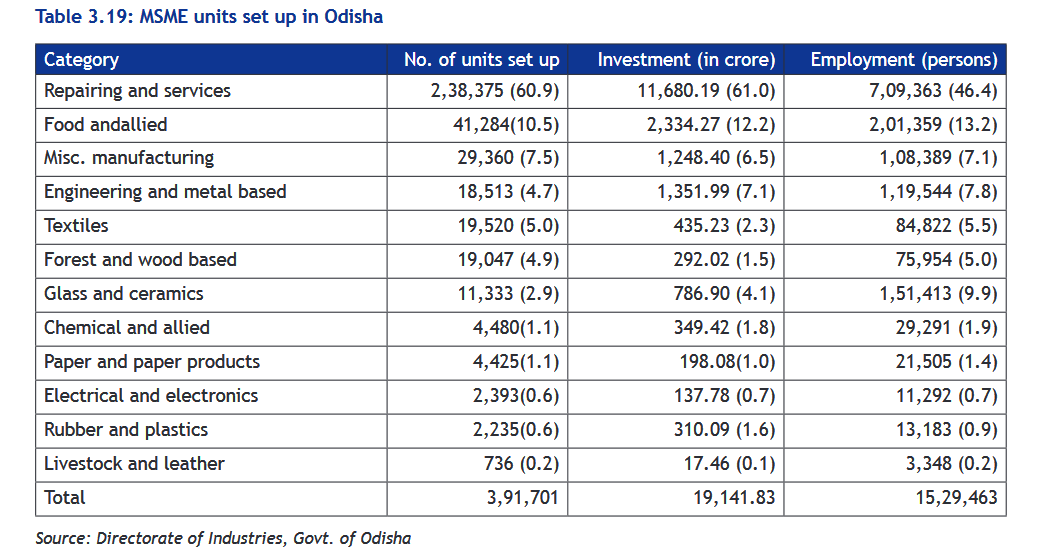

"Economic Survey of Odisha 2019-20":

SMEs are widening their domain across sectors of the economy, producing diverse range of products and services to meet demands of domestic as well as global markets.

With effect from 1st July, 2020:

An enterprise shall be classified as a micro, small or medium enterprise on the basis of the following criteria, namely:

For registration of MSME, you need to take "Udyam Registration".

Challenges faced by Small and Medium Enterprises:

- Lack of capital and credit from banks and financial institutions

- Lack of good infrastructure

- Lack of advanced technology

- Lack of competitiveness with the multi-national companies

- Lack of proper training and skills

- Lack of effective marketing channels

To deal with the above mentioned issues, the Government of India has come up with many incentive schemes for these enterprises. Various schemes have been designed like credit guarantee scheme, subsidy scheme, infrastructure support schemes, etc.

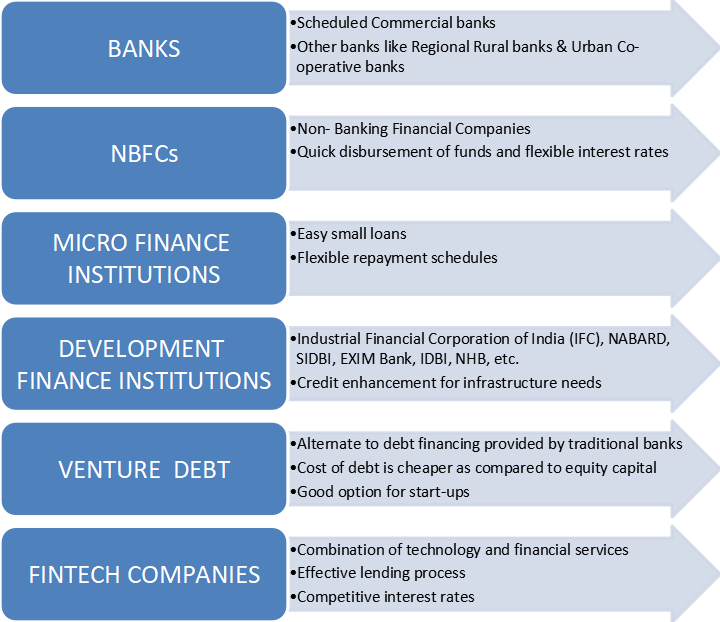

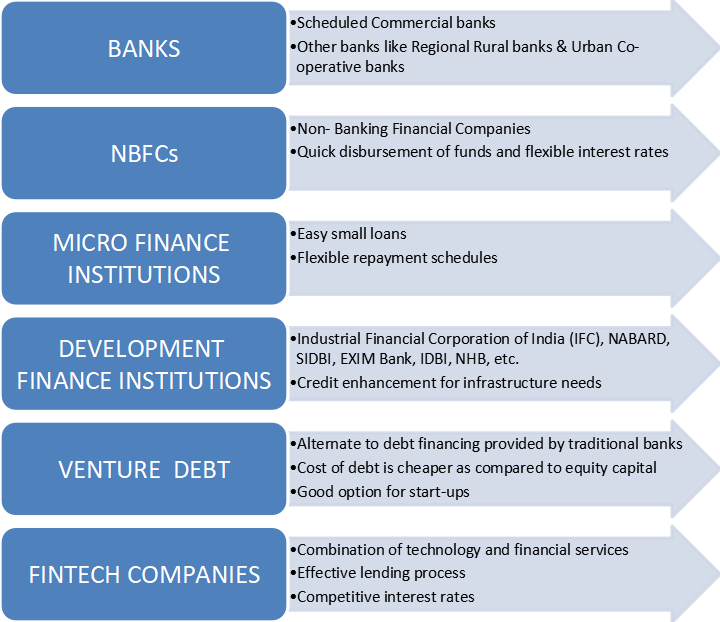

FINANCING SOLUTIONS TO MSME:

In today's emerging digital era, Fintech companies are playing a major role in providing financing solutions to Small and Medium enterprises. Let's have a look at the important aspects of the Fintech companies: